Introduction to Computer Vision AI

Computer Vision (CV) AI enables machines to interpret visual data like humans. In this blog, we'll be exploring how this technology is revolutionizing the insurance sector by automating and enhancing processes such as:

Automating claims processing

Enhancing fraud detection

Improving customer service

Refining risk assessment

This technology extracts critical information from images and videos, streamlining decision-making and automating manual tasks. It saves time, money, and increases efficiency and accuracy in insurance operations.

Computer Vision AI is reshaping how insurers assess risk, process claims, and engage customers, making it essential in modern insurance. At the end, we'll offer a way to intergrate CV for insurance seamlessly with ezML.

Revolutionizing Insurance with Computer Vision AI

In an era where digital transformation is not just a buzzword but a business imperative, the insurance sector stands at a crossroads. Traditional models, characterized by manual processes and extensive paperwork, are being challenged by the rapid evolution of technology. Among these technological advancements, Computer Vision AI emerges as a game-changer, offering unprecedented opportunities for innovation and efficiency. At ezML, we are at the forefront of this revolution, providing a low-code cloud platform and lightning-fast custom development to seamlessly integrate advanced Computer Vision functionalities into countless insurance applications.

The Transformative Power of Computer Vision AI in Insurance

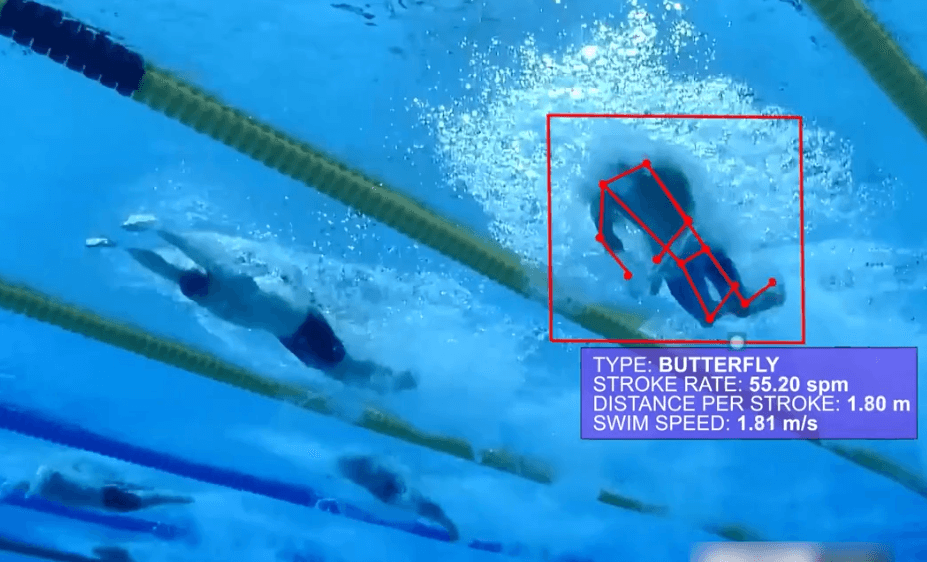

Automating Claims Processing with Precision

Imagine the ability to process claims in minutes, not days. That's why one of the most compelling applications of Computer Vision AI in insurance is in claims processing. Traditionally, this process involves manual inspections, documentation, and assessments, which can be time-consuming and subject to human error.

With powerful computer vision models facilitated by platforms like ezML, insurance companies can easily leverage Computer Vision to automatically assess damage from images or videos submitted by policyholders. This not only speeds up the claims process but also enhances accuracy and customer satisfaction.

Innovative Fraud Detection Methods

Fraudulent claims can significantly impact an insurance company's bottom line. By analyzing patterns and inconsistencies in visual data, computer vision models can identify fraudulent claims with a higher degree of accuracy than ever before. This capability not only saves millions of dollars but also protects the integrity of insurance operations.

Streamlining Customer Service

Tired of a limited chatbot? Computer Vision AI paired with a large language model (LLM) can also revolutionize customer service in insurance. ezML's platform enables the development of intelligent virtual assistants that can visually identify and understand customer issues, provide instant solutions in text, and even guide users through complex insurance processes. This level of interactive and personalized service was unimaginable until recently with the advent of Visual Question Answering (VQA) models. Check out the magic with ezML's powerful Visual QA API: Docs

Sectors of Insurance Enhanced by Computer Vision

And computer vision AI has TONS of applications across various insurance sectors. Here are some key areas our team saw as substantial impacts throughout our computer vision services:

Auto Insurance:

Automated damage assessment for rapid claims processing.

Detection of fraud through analysis of accident scenes and damage consistency.

Health Insurance:

Processing and analysis of medical images for faster claim verification.

Automated patient data extraction from medical documents and imaging.

Property Insurance:

Property damage assessment from images or drone footage for quick claims resolution.

Risk assessment and disaster evaluation through satellite and aerial imagery.

Life Insurance:

Automated underwriting through analysis of medical reports and images.

Enhanced customer verification and fraud prevention measures.

Travel Insurance:

Fast processing of claims related to lost or damaged luggage through image recognition.

Verification of accident or medical claims through document and image analysis.

Workers' Compensation:

Injury documentation and verification through image analysis.

Workplace safety compliance monitoring through video surveillance.

Real-World Success with ezML

If you're an insurance company interested in leveraging AI, look no further. The ezML team has empowered insurance companies across multiple sectors to transform their operations.

For instance, our automated damage detection model has already made waves in the auto insurance sector with clients reporting a 60% reduction in processing time for vehicle damage claims, coupled with significant improvements in fraud detection rates thanks to our cutting-edge technology. This not only resulted in substantial cost savings but also elevated customer satisfaction by providing faster and more transparent claim resolutions.

Such success stories beyond just ezML underline the practical value and impact of integrating Computer Vision AI into insurance tech.

Why ezML is the Future of Computer Vision for Insurance Tech

Serverless Infrastructure: Say goodbye to hardware worries and scalability issues. Our platform is designed for efficiency and performance.

Zero-shot Learning Models: Leverage ezML's proprietary zero shot AI models capable of understanding and processing images without extensive training data, boosting speed to production.

Prebuilt Computer Vision Models and Custom Development: ezML offers a wide range of prebuilt models tailored for insurance applications, combined with the domain expertise for custom development. This blend of ready-to-use solutions and configurability ensures that companies can rapidly deploy Computer Vision capabilities, perfectly aligned with their unique needs and challenges.

Optimized for Efficiency: Our platform is fine-tuned and proven for cost and performance, ensuring you get the best ROI.

Welcome to the Future

Join the ranks of insurance companies transforming their operations with Computer Vision AI. **Schedule a free consultation with ezML's founders today**to see how we can tailor our solutions to meet your specific needs, driving your insurance operations towards greater efficiency and customer satisfaction.

And if you just want to learn more with no strings attached, still feel free to schedule a call because we love meeting new people!